"

Smart investors don't trade on tweets. They know that markets are affected by many variables that we can't predict.

"

Jared Friedman, CFP®

Financial Lesson:

Don't Get Your Stock Tips From Twitter

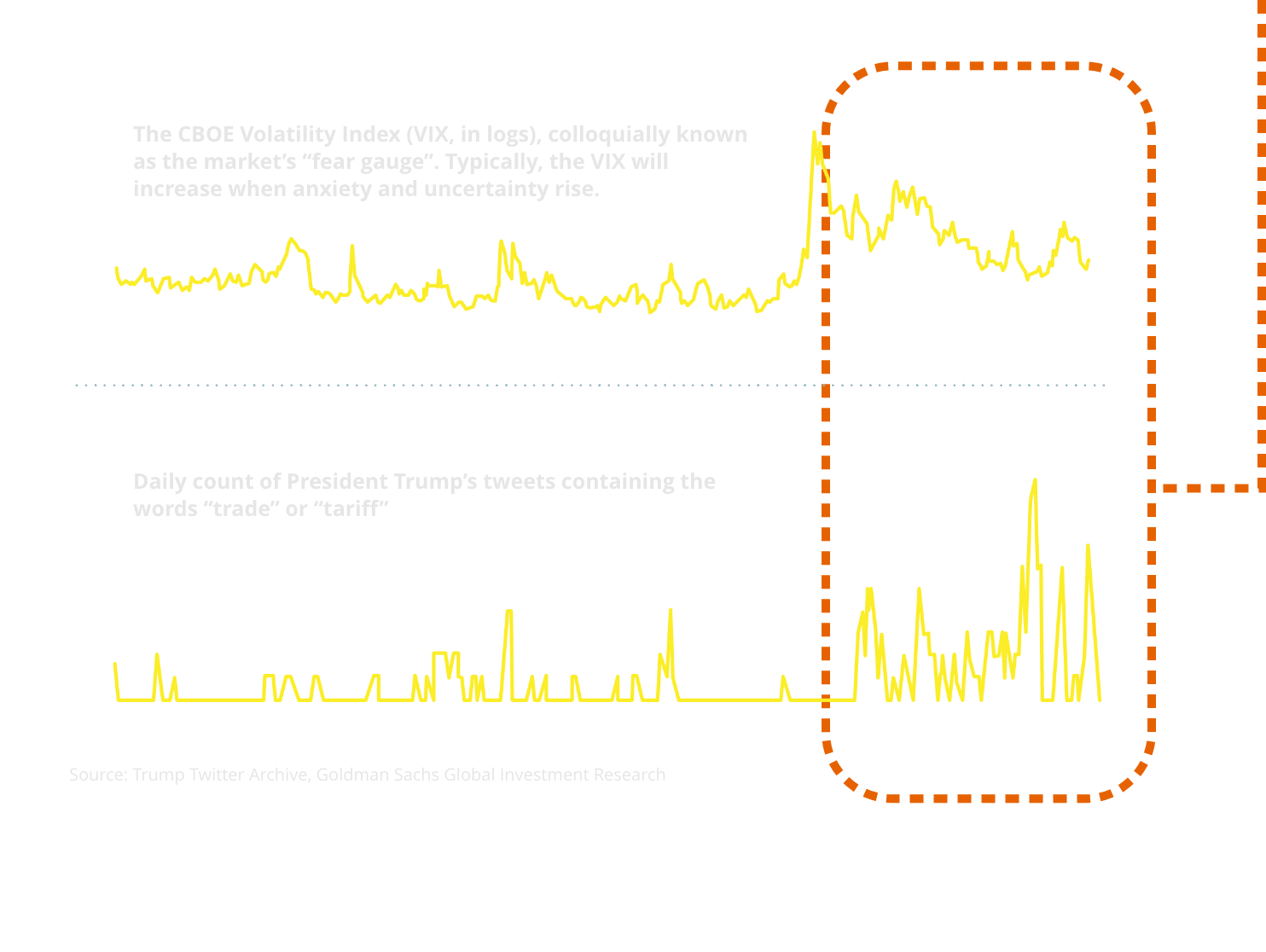

Is there a measurable Trump tweet effect on stocks? Sometimes.

Positive or negative publicity can affect a stock's price. The president's tweets may cause short-term volatility in stock prices, but much of that may be attributable to the headlines generated by media coverage.

Over the long term, the stock market tends to mirror underlying economic fundamentals; however, in the short term, markets can turn on a dime, reacting unpredictably to a wide variety of events, including a tweet, off-hand remark, or media headlines.

Smart investors don't focus on what happens in the minutes and hours following a presidential tweet. They keep their own goals in sight and focus on a solid financial strategy for the months and years that follow.

If you have larger concerns about markets and how politics may affect your financial strategies, give my office a call at 908-663-2125 or send me an email at Jared@redwoodplanning.com. I'd be happy to set up a time to speak with you.

Jared Friedman, CFP®

Redwood Financial Planning

908-663-2125

Jared@redwoodplanning.com

P.S. Do your friends and loved ones worry about whether or not President Trump's tweets could affect their investments? Give them peace of mind by sharing this infographic.