Gregg Hartmann · Summit Investment Advisors

Why Market Highs Feel So Scary

(Even When History Says “Relax”)

Markets are up. Your portfolio looks strong.

So why does it feel like a drop is coming?

If you’ve ever thought, “This must be the top,” you’re in good company. That fear is hardwired into our brains.

But here’s the truth: Historically, investing at new highs delivers returns similar to buying at any other time.

This short read breaks down the psychology behind “that fear” and why the data tells a different story.

"It’s not about ignoring fear. It’s about understanding where it comes from and what the data actually says."

Not receiving our newsletter?

Get insightful info on finances and more in your inbox every month with the

VISUAL INSIGHTS NEWSLETTER

The Mental Math That Misleads Us

Buying at Highs ≠ Buying at the Wrong Time

It feels risky to invest when markets are riding high. But history tells a different story.

Over the past 70+ years, buying at all-time highs has delivered returns nearly identical to investing on any random day.

The average 1-year return after a market high? 11.2%. On other dates? 12.6%. At 3- and 5-year marks, the difference stays small.1

Of course, past performance doesn’t predict future results.

But the numbers are clear: market highs aren’t a red flag. They’re part of the ride.

Anchoring Bias: Yesterday’s Price Still Lives in Your Head

So if investing at highs isn’t actually riskier…why does it feel that way?

Blame anchoring bias: our tendency to fixate on the first number we see.^2

Maybe you saw a stock at $455 a few months ago and waited. Now it’s $490.

It feels expensive, even if nothing’s changed.

This type of mental math leads to regret and inaction.

But markets aren’t priced for where they’ve been. They’re priced for where they might go.

We Remember the Crashes, Not the Climbs

Anchoring bias isn’t the only thing at play.

Our brains also exaggerate whatever happened most recently, especially if it ended badly.

That’s why highs feel scary.

If the last one you remember preceded a drop, that’s what sticks.

Not the years of growth. Just the drop.

It’s like a great vacation spoiled by an awful airport delay. One bad moment overshadows the rest.

Investing can feel the same.

One crash after a peak doesn’t make every high a warning. But your brain treats it like one.

Control Feels Safer Than Action

Moreover, buying at new highs feels risky because it means surrendering control.

If the market dips, regret hits harder: “Why didn’t I wait?”

That’s regret aversion at work. We’d rather do nothing than risk feeling foolish.3

And sitting in cash creates a false sense of control, even though markets rarely follow our script.

This illusion of control can be comforting. But long-term success usually comes from staying consistent, not trying to outsmart uncertainty.

The High Price of Sitting Out

When markets are volatile, it can feel reasonable to take a cautious approach. But stepping out--even briefly--has historically come with tradeoffs.

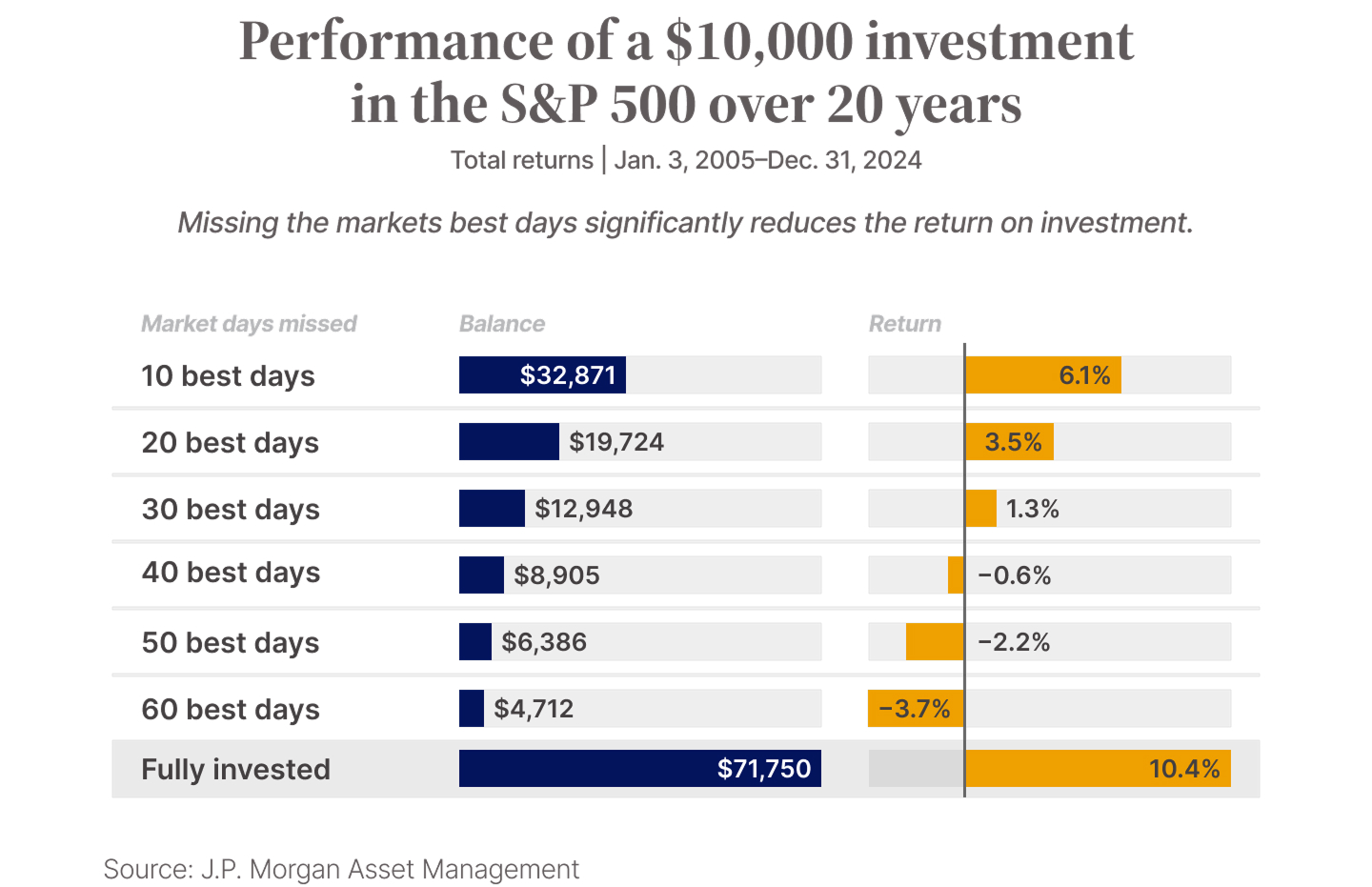

From 2005 to 2024, a hypothetical $10,000 investment in the S&P 500 grew to $71,750 if left untouched the entire time.4

Missing just the 10 best days during that same period would have reduced that value to $32,871--a much lower outcome over two decades.4

It's also worth noting that 7 of those 10 best days occurred within two weeks of the worst days. That suggests some of the strongest gains tend to cluster around periods of heightened uncertainty.4

While past performance doesn't guarantee future results, this underscores how difficult it can be to predict the right moments to be in or out of the market.

While the illusion of control can be comforting, long-term success usually comes from staying consistent—not trying to outsmart uncertainty.

It’s Not About Timing. It’s About Trusting the Process.

The bottom line…

Feeling anxious at a market high is normal. You’re not doing it wrong. You’re just human.

The key is knowing how your brain might be playing tricks on you and building a plan that keeps those instincts in check.

If you’re not sure what to do next, that’s okay. Let’s figure it out together.

Sincerely,

Gregg Hartmann

Senior Wealth Manager

P.S. Sign up for my emails. My subscribers get my best insights.

Gregg Hartmann

Senior Wealth Manager

https://summit.ceterainvestors.com/

Not receiving our newsletter?

Get insightful info on finances and more in your inbox every month with the

VISUAL INSIGHTS NEWSLETTER

Gregg Hartmann

Senior Wealth Manager

.png)

.png)

-

Bloomberg, RBC GAM, 2024 [URL: https://www.rbcgam.com/en/ca/learn-plan/investment-basics/investing-at-all-time-highs/detail]

-

The Decision Lab, 2025 [URL: https://thedecisionlab.com/biases/anchoring-bias]

-

The Decision Lab, 2025 [URL: https://thedecisionlab.com/biases/regret-aversion]

-

CNBC, 2025 [URL: https://www.cnbc.com/2025/04/07/selling-out-during-the-markets-worst-days-can-hurt-you-research.html]

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Cetera Investors is a marketing name of Cetera Investment Services. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Advisory services are only offered by Investment Adviser Representatives. Cetera is under separate ownership from any other named entity. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency.

Confidential: This email and any files transmitted with it are confidential, and are intended solely for the use of the individual or entity to whom this email is addressed. If you are not one of the named recipient(s) or otherwise have reason to believe that you have received this message in error, please notify the sender and delete this message immediately from your computer. Any other use, retention, dissemination, forward, printing, or copying of this message is strictly prohibited.

Become an Insider

Get insightful updates on markets and the world delivered straight to your inbox every month.

No thanks

You're Signed Up!

Gregg Hartmann

Senior Wealth Manager

Stay tuned — an email from me is on its way to your inbox right now.

.png)

.png)

.png)